what is a fit deduction on paycheck

FIT deductions are typically one of the largest deductions on an earnings statement. FIT on a pay stub stands for federal income tax.

What Are Payroll Deductions Article

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

. OT15 - Overtime pay at 15 times your regular pay rate OnCall - On-call pay. FIT deductions are typically one of the largest deductions on an earnings statement. Federal income tax FIT is withheld from employee earnings each payroll.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Payroll taxes and income tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

The employee can adjust the FIT deduction by filing a W-4 however paying below true tax liability may result in a fine when filing taxes. Fit deductions are typically one of the largest deductions on an earnings statement. In California the State Disability Insurance SDI could be used as a Schedule A.

Reg Pay - Regular pay - hourly. FIT is applied to taxpayers for all of their taxable income during the year. FIT is the amount required by law for employers to withhold from wages to pay taxes.

These items go on your income tax return as payments against your income tax liability. Should I Claim 0 or 1 If I am Married. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. What is fit deduction on my paycheck. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. FIT represents thededuction from your gross salary to pay federal withholding also known as income taxes. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

This amount is based on information provided on the employees W-4. Multiply one withholding allowance for your payroll period see Table 5 below by the number of allowances the employee claims. FICA stands for Federal Insurance Contribution Act.

The amount of money you. Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups.

In respect to this what is fit deduction on my paycheck. In the United States federal income tax is determined by the Internal Revenue Service. Should I claim 0 or 1 if I am married.

Employees federal withholding allowance amount. However FUTA is paid solely by employers. This tax includes two separate taxes for employees.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Social Security and Medicare. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

FIT tax pays for federal expenses like defense education transportation energy and the environment and interest on the federal debt. After subtracting the standard deduction of 25100 your taxable income for 2021 is 64900. What is fit WH on my paycheck.

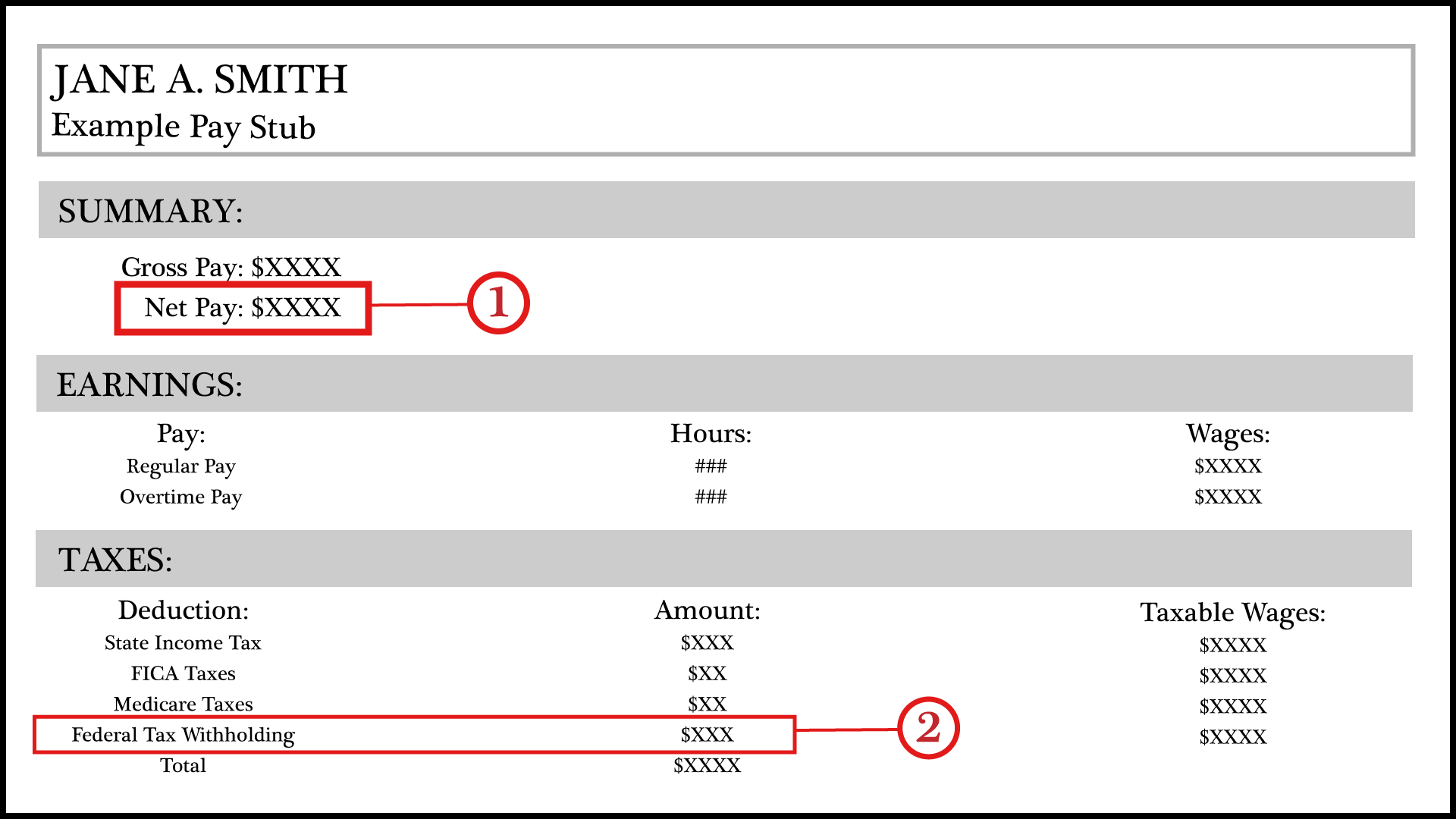

Employees generally receive a paycheck along with additional information an earnings statement explaining how the amount on the check was calculated. Fit federal income tax - margnl table as requested na every fitad federal income tax - added amount as requested na every fsaf flexible spending account fee 325 post tax 2 nd garn garnishment as required post tax every garnf garnishment fee 300 post tax every gncu greater nv credit union as requested post tax every. What is FIT tax.

The FIT deduction on your paycheck represents the federal tax withholding from your gross income. How do you calculate fit tax. To use these income tax withholding tables that correspond with the new Form W-4 find the employees adjusted wage amountYou can do this by using the worksheet that the IRS provides in Publication 15-T.

To calculate your tax bill youll pay 10 on. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

FIT deductions are typically one of the largest deductions on an earnings statement. FIT deductions are typically one of the largest deductions on an earnings statement. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

Federal income tax deduction can be abbreviated fit deduction. Employers withhold or deduct some of their employees pay in order to cover. That puts you in the 12 tax bracket.

Additional income credits deductions and other withholding requested on Form W-4. Its calculated using the following information. PTO - Personal time off or paid time off.

FIT deductions are typically one of the largest deductions on an earnings statement. Federal income tax is withheld from each W-2 employees paychecks throughout a tax year. Federal Unemployment Tax Act FUTA is another type of tax withheld.

Misc - Miscellaneous pay pay they dont have a code for Move Rem - Move reimbursement. TDI probably is some sort of state-level disability insurance payment eg. Federal Income Tax FIT and Federal Insurance Contributions Act FICA.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Net - Earnings after taxes and deductions. Federal income tax deduction can be abbreviated FIT deduction.

The following taxes and deductions are what you can expect to see on your paycheck explained in detail below. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. In a payroll period the taxes deducted from a paycheck typically include Social Security and Medicare taxes otherwise known as FICA Federal Insurance Contributions Act.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Jury - Jury duty pay. FIT deductions are typically one of the largest deductions on an earnings statement.

There are two main methods for determining an employees federal income tax withholding.

What Everything On Your Pay Stub Means Money

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Payroll Deduction Authorization Form Template Ad Sponsored Deduction Payroll Authorization Template F Payroll Deduction Templates Printable Free

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization

Deluxe Paystub Paycheck Statement Template Doctors Note

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Employee Life Insurance Employee Benefit Benefit Program Business Insurance

Payroll Payroll Federal Income Tax Business

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

Explore Our Example Of Pay Stub Template For Truck Driver For Free Payroll Template Statement Template Business Template